FHA Loan Benefits

- Low down payment.

- Low closing costs.

- Those with low credit score can still qualify.

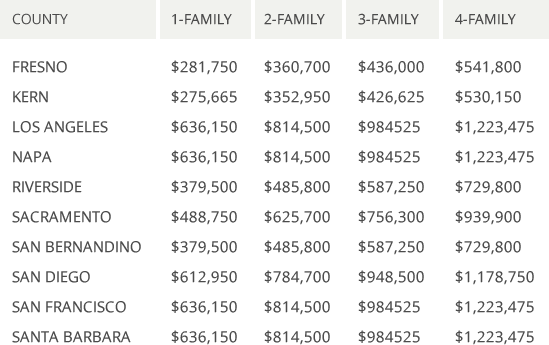

The FHA loans are great for first time buyers. They can offer with down payment as low com 3.5% of the house and can cover many of the closing costs. The FHA loans are available for 1-4 unit properties.

FHA loans also covers for buying houses that need to be repaired or remodeled. The costs of repairs may also be included in a single loan.

If you are already a homeowner and want refinaciarla including costs of repairs or remodeling can also be included.

FHA can help you make your home more efficient in energy saving. If saving money on energy, you can include equipment to improve savings.

FHA can cover the purchase of any home including mobile or manufactured homes.

If you already have an FHA loan and want to improve the interest rate that is possible with the refinaciamiento called FHA Stremline, which allows you refinaciar your home if you spend on valuation of the house without income verification. All that is needed is employment verification.

For those with a low credit score (FICO Score), FHA can help you buy your home. Often buyers with low credit score would be disqualified on conventional loans but FHA might approve you if the ability to repay the loan is demonstrated.

Applicants must have stable employment, Social Security valid for employment and ownership needs to be valued by a professional.